Business

Optimize your business setup with proficient information and essential resources for smooth registration processes.

INVEST WITH US!

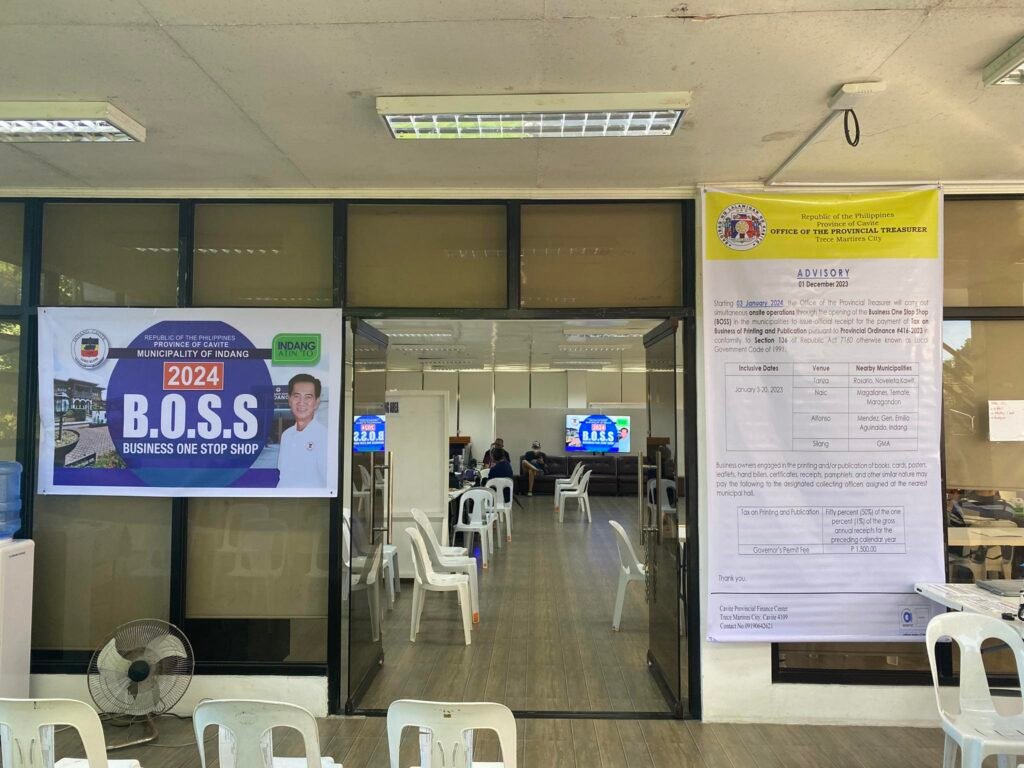

Before starting commercial operations, all businesses require a Business License and Mayor’s Permit, as well as pay applicable business taxes.

A newly established business is not subject to business taxes. For business renewals, business tax is calculated based on gross sales/receipts from the previous calendar year. Payments can be made annually, semiannually, or quarterly. Business taxes are due in the first 20 days of each quarter. When a tax payer fails to renew his or her business permit within the first 20 days of each quarter, a 25% surcharge and 2% interest are charged per month.

The license must be renewed every year between January 1 and January 20. Penalties are imposed after this time period.